The Chinese market is becoming a must for any foreign B2B company’s long-term growth vision. According to 2023 data from Statista, B2B eCommerce transaction volume in China grew at a CAGR of 8%, reaching 33.89 trillion yuan (US $4,758 billion), and is expected to continue its growth trajectory.

As international firms continue to expand into China’s B2B market and digitalization quickly takes place, it is crucial to understand the distinct regulatory & compliance, technological, and competitive factors that uniquely shape this digital business environment and allow firms to remain competitive in the market, successfully engage with customers, and improve sales processes.

Current State of China’s B2B eCommerce Market: Trends and Drivers

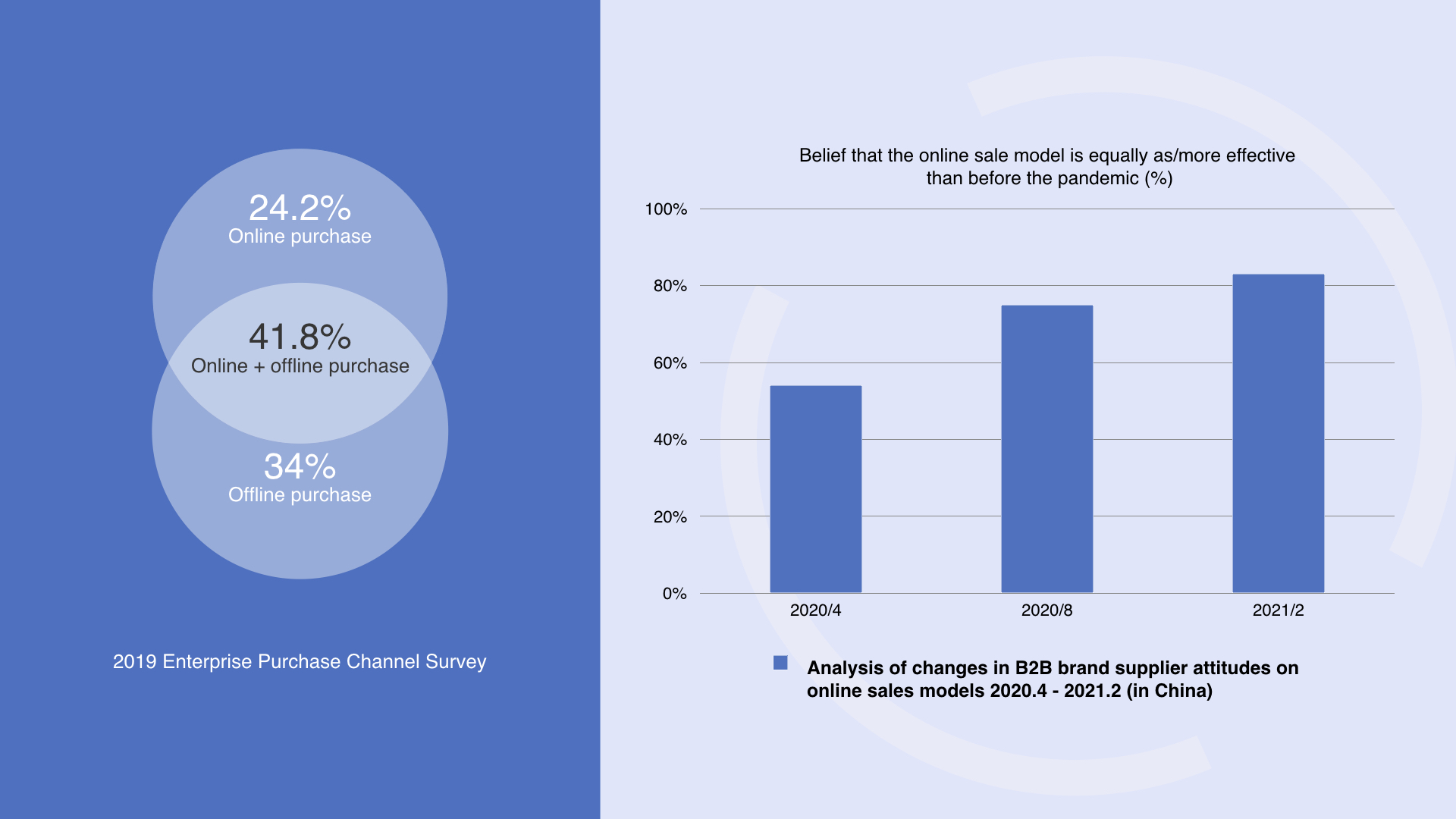

China’s B2B sector is increasingly digital, with adoption rates rising in response to digitalization, convenience, and governmental support for online procurement. According to recent studies, 83% of Chinese B2B brands now prioritize online sales, indicating a strong shift toward digital-first interactions.

Similarly, a survey by McKinsey on Chinese B2B buyers shows digital self-service and remote rep interactions will be the dominant elements of B2B moving forward, with 90% of decision-makers expecting to make purchases in an end-to-end self-serve model. This shows encouraging trends in favor for digital models across all stages of the procurement process, from Identifying and Researching New Suppliers, to Consideration and Evaluation, Ordering, and Reordering.

Factors Accelerating the Trend of B2B Online Procurement

China’s fast pace of digital innovation has quickly transformed B2B procurement dynamics and was already well underway before COVID-19 struck, shaping a mature B2B market whose innovations can also be taken as a reference for digital transformation abroad. From specialized marketplaces to self-operated distribution platforms, there are lessons to be learned from China’s digital ecosystem into where B2B is headed. Other important contributing factors to this include:

- Favorable policies of the Chinese government towards Online Procurement.

- Rising costs of running a business (with eCommerce and its decreased overheads being one way to reduce them).

- Development of Online Purchasing Habits, with more companies now choosing to purchase through contactless payment methods (something which the pandemic has also accelerated)

- New Technologies that facilitate online procurement such as Cloud Computing, Big Data, the Internet of Things (IoT), and AI (artificial intelligence).

- Industry standards in the infrastructure of the eCommerce industry, leading to a general improvement of the online user experience.

- Digitalization of Chinese Internet users, especially the entry into the job market of digital natives born in the 80s and 90s.

Despite the growing trend towards online procurement, some companies still face challenges in transitioning to digital channels. For instance, in industries like Chemicals, sales depend heavily on distributor networks, and Distributors have established strong customer relationships by providing various offline services, which makes it difficult for companies to change this model. As a result, there may be reluctance to disrupt a well-established system that has worked well for both parties.

Industry Opportunities for B2B eCommerce

The B2B eCommerce market in China is expected to experience substantial growth in the upcoming years, spanning various industries. B2B can be classified into three categories:

- Downstream: products close to the consumer, such as clothing, medicine, and fast-moving consumer goods.

- Midstream: products close to production, such as textiles, auto parts, and smelting.

- Upstream: products at the top end of production, including non-ferrous metals, steel, and petroleum.

The bulk commodity eCommerce market accounts for 80% of the entire market, with the eight major industries being Chemical, Energy, Rubber and Plastics, Nonferrous Metals, Steel, Textiles, Building Materials, and Agriculture undergoing significant digitalization in recent years.

China’s industrial B2B sector is seeing considerable growth across several product categories, including maintenance, repair, and operations (MRO), as well as specialized industries like electrical engineering, automotive, and chemicals. Platforms tailored to these sectors, such as MRO’s dedicated channels, provide optimized procurement solutions that are transforming the industry. By 2024, it is anticipated that industrial product B2B eCommerce will grow at a rate of 25-30%, indicating the high potential for sector-specific digital transformations.

B2B Ecosystem Landscape: Platforms and Service Providers

China’s B2B eCommerce landscape is diverse, with three primary types of platforms:

- Traditional Marketplaces: Platforms like Taobao, Tmall, and JD that have adapted to B2B but remain rooted in B2C structures.

- B2B Subsidiary Platforms: These include “one-stop” comprehensive generalist platforms like Alibaba’s 1688.com and vertical industry-specific marketplaces for sectors like automotive, textiles, and electronics. These platforms cater to businesses with specific needs, helping streamline procurement within particular industries.

- Brand-Owned Platforms: Increasingly popular, these platforms allow companies to directly connect with customers, offering a controlled and differentiated digital experience. Global brands such as Gree, Haier Group, Schneider, and 3M have already built their own platforms.

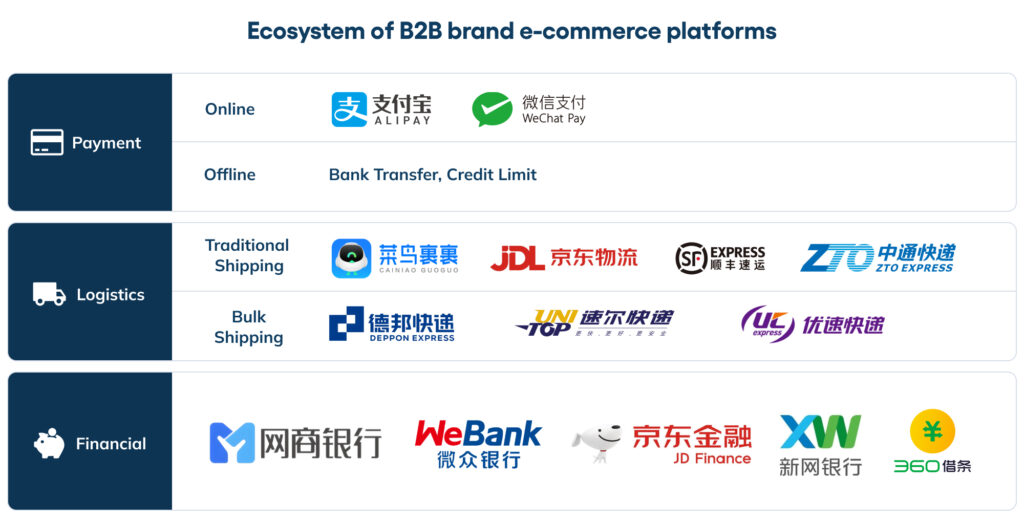

An essential part of the ecosystem includes payment providers (Alipay, WeChat Pay), logistics partners, and financial service providers, all crucial for navigating China’s highly integrated B2B environment.

The Surge in Brand-Owned B2B Platforms

While third-party platforms like 1688.com offer broad market access, they come with limitations: limited brand control, restricted data access, and increased competition among similar brands. As China’s digital ecosystem matures, the trend of brand-owned platforms has gained traction thanks to the critical advantages they can provide:

- Enhanced Customer Experience and Loyalty: With direct engagement channels, companies can customize every aspect of the user experience.

- Data Ownership and Strategic Insights: Owning a platform allows businesses to capture valuable customer data, enabling data-driven decisions and deeper personalization.

- Operational Flexibility and Regulatory Compliance: A dedicated platform ensures compliance with local regulations and provides operational control to adjust and innovate as the market evolves.

Common Branded eCommerce B2B Models

1. Branded B2B Platform Model (B2B)

This model refers to a direct selling approach where companies offer their products to other businesses through their official self-operated website. This enables companies to manage every aspect of the eCommerce process, including logistics, customer service, and product information. One of the advantages of this approach is that it allows companies to maintain high levels of customer service.

2. Distribution Model (B2B2C)

This model involves companies partnering with distributors to sell their products through the distributor’s existing distribution channels. The company focuses on producing the product while the distributor handles fulfillment and customer relations. This model can be advantageous for both parties, with the company able to increase brand exposure and the distributor able to share in profits or receive commission from sales. It is a mutually beneficial relationship that can lead to increased sales and market reach for both the company and the distributor.

3. Online-to-Offline Model (O2O)

In the context of B2B, the O2O model can be used to leverage the distributor’s local presence and expertise in providing value-added services such as installation, maintenance, and technical support to customers. This can help companies to establish a closer relationship with customers and improve customer satisfaction. In addition, the O2O model can also help to reduce logistics and delivery costs by leveraging the local distribution network.

Approach Digital Transformation in Phases for B2B Brands

China is currently undergoing a significant digital transformation in its traditional industries, especially in Manufacturing. As for B2B, a model that is expected to gain wider adoption is the consumer-to-manufacturer (C2M). In it, the end customer connects directly with the manufacturer to place orders, thus bypassing middlemen in the distribution process. This helps reduce costs, increase efficiency, and minimize production waste, as well as an opportunity for manufacturers to build long-term relationships with their customers through direct contact.

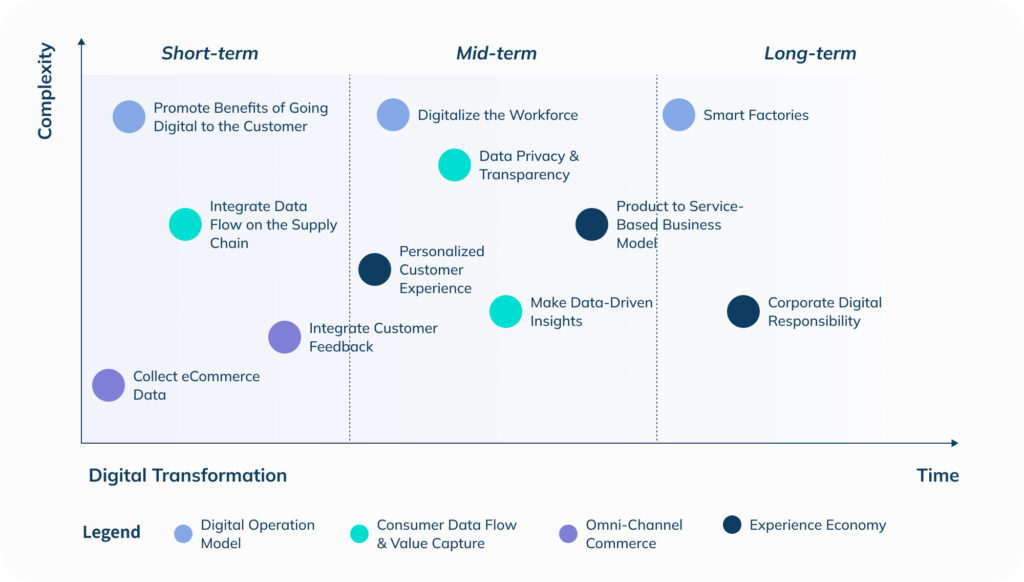

Regardless of the business line, digital transformation is a long-term business strategy that requires careful planning and can translate into greater supply chain visibility, better order management, operational excellence and flexibility, reduced risk and cost of b2b finance operations, and shortening of the sales cycles

The journey to digital transformation can be broken down into 3 phases, each requiring varying amounts of time to complete, depending on the industry and location of the company:

- Early Stage (1-2 years): This stage focuses on data collection, user acquisition (customers, partners, employees), and user education.

- Mid Stage (2-4 years): This stage focuses on data management, user personalization, and activation.

- Mature Stage (4-8 years+): This stage focuses on smart technology and the complete digitalization of all aspects of the company.

Short-Term Digital Transformation Goals

- Build customer data sets: In the early stages of eCommerce, it’s important for companies to collect as much customer data as possible to build customer profiles and understand their journey across various touchpoints.

- Integrate customer feedback: Departments should collaborate to collect customer feedback in an integrated manner, allowing them to gain a better sense of customer preferences and expectations.

- Integrate data flow on the supply chain: Real-time data integration of the entire supply chain can increase logistics efficiency, allowing suppliers and distributors to manage inventory more effectively and optimize production levels.

- Promote the benefits of digital to customers: Companies may encounter resistance from customers who are hesitant to shift from traditional sales models. By promoting the benefits of online purchasing, such as the ease of repurchasing, both parties can reap long-term benefits.

Mid-Term Digital Transformation Goals

- Use data-driven insights: Companies with comprehensive data sets can gain insights through big data analysis to inform decisions on marketing, eCommerce website development, and more.

- Personalize the customer experience: B2B eCommerce companies need to be user-focused to provide a customized experience that reflects customers’ payment preferences and purchasing patterns.

- Adhere to data privacy and transparency regulations: As companies grow, they must prioritize data security and transparency to earn trust, which can be achieved by disclosing information about products and supply chains.

- Digitize the workforce: Digitalizing the workforce can improve communication, productivity, and workflows across departments.

- Shift to a product-as-a-service (PaaS) business model: Instead of selling just the product, companies charge for the services that come from it, focusing on the outcomes it provides. This model has become more prevalent with IoT technology, and companies like Cao Cao in China are planning to lease self-driving cars for their ride-hailing service, rather than selling the cars themselves.

Long-Term Digital Transformation Goals

- Leveraging Smart Factories: In the Industry 4.0 model, smart factories utilize IoT technology to operate sensors that collect real-time data. This data can be used to manage processes and workflows in the manufacturing process, and robotic machines can now handle many manual processes. This allows for greater adaptability to different product flows and the production of customized products and services.

- Promoting Corporate Digital Responsibility: As companies become increasingly digitalized, they must consider the ethical implications of their actions. This includes ensuring data transparency and producing products that align with the ethical concerns of their customers, such as using environmentally friendly materials. Ethical considerations also extend to the handling and analysis of data, and companies must take responsibility for their digital actions.

(Source: TMO Group – for more info contact them HERE)

Sign Up to Receive China Updates Weekly Newsletter for FREE, HERE

Visit HPA-China’s Information Hub, HERE