Douyin Zibo (自播) (Chinese Tik Tok), AKA Douyin live-streaming hosted by the brand, is a trending marketing method in China.

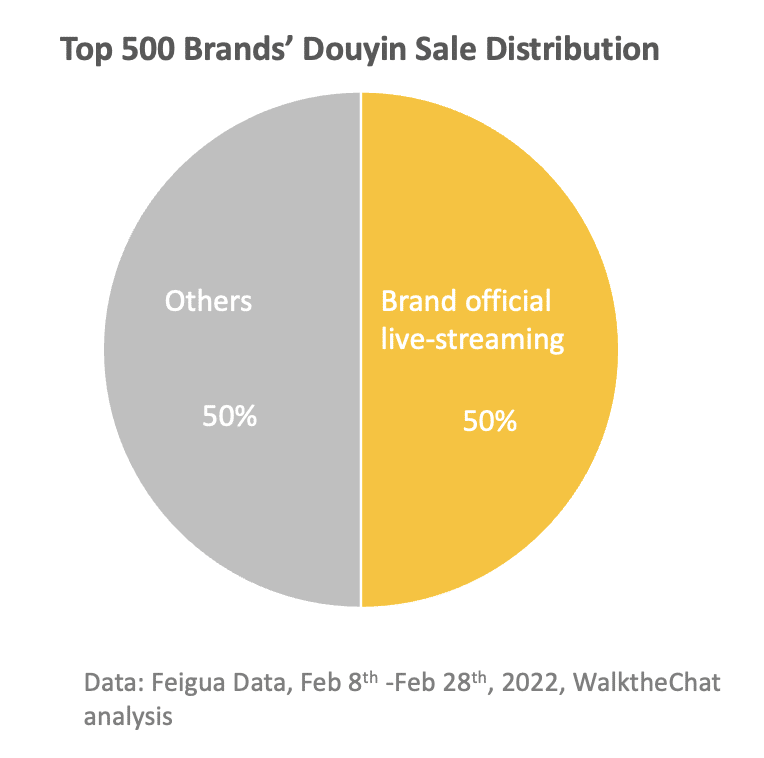

In Feb 2022, 50% of the total Douyin sales of the top 500 brands came from the brand’s own official live-streaming.

During the 618 e-commerce holiday in 2022, a total of 25 brands’ official Douyin live-streaming reached over 100 million RMB in sales. The top brands include Xiaomi, Adidas, Estee Lauder, Apple, and Nike.

Also, brands’ official live-streaming represented 57.7% of the total Douyin e-commerce live-streaming time on June 18th, 2021 (the rest was live-streaming by influencers), according to East Money.

To break down the Douyin live-stream strategy, we will cover:

- What’s brand Douyin live-streaming

- How to optimize Douyin Live-streaming

- Should brands invest in Douyin live-streaming?

- Case study

What’s brand live-streaming?

Brand live-streaming is a live-streaming session hosted by the brand’s official account (and not by a 3rd party influencer).

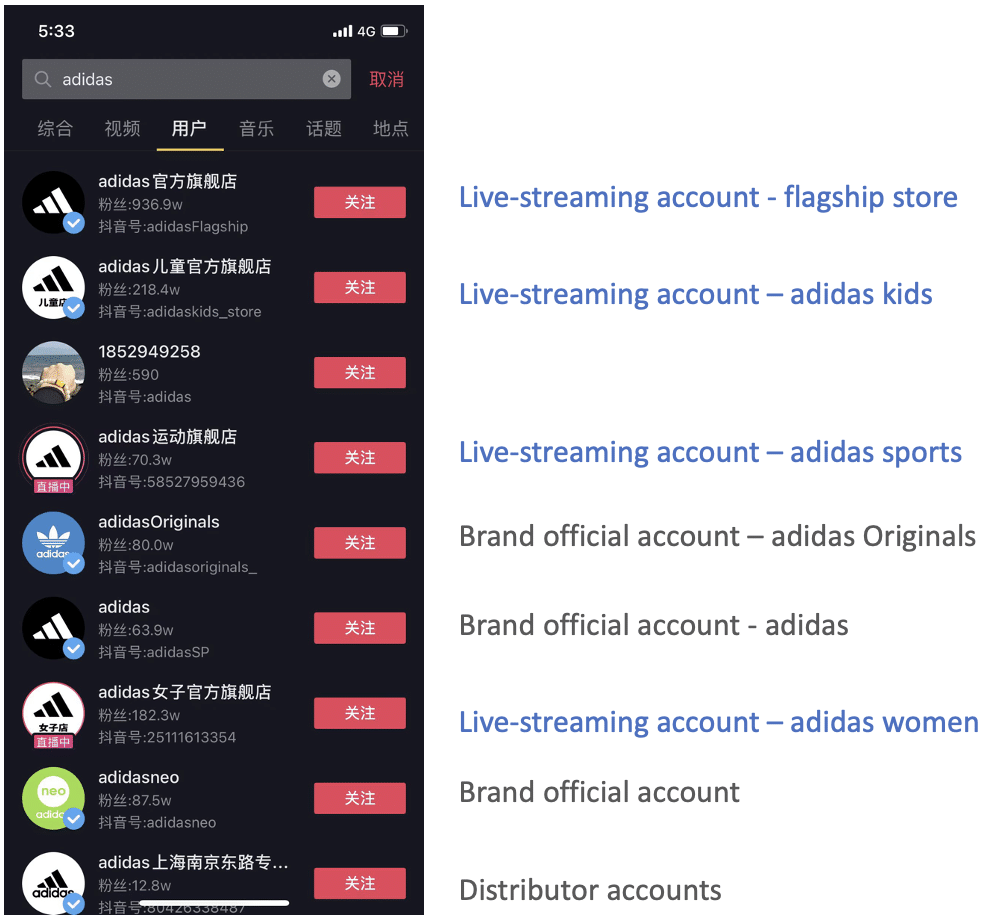

Dedicated account just for live-streaming

Many brands choose to set up different Douyin accounts specifically for live streaming. For example, Adidas has over 4 live-streaming accounts for different audience groups: the flagship store, women, kids, and distributor stores.

The content on those live-streaming accounts is simple and short clips from live-streaming. Most editing is just to add background music and Douyin effects.

Such content positioning is very different from Adidas’ main official account, which only shares high-budget creative content.

Hours-long

Lots of these live-streaming accounts run on insane live-streaming hours of over 15 hours per day. Usually, the live-streaming has one host, often a female, selling over 50 discounted products.

Despite this time commitment, the viewer count (the number of viewers watching the live video at one time) is extremely low. Even for the top 500 Douyin brands, the average viewer count is often below 100. This would accumulate over 100k daily viewers in total.

Compared to the viewer amount, the sales result is impressive. For example, Under Armour’s max viewer count could be 100, with a total of 100k daily views, and the daily sales could reach over 300k RMB. Douyin users tend to make quick and impulse purchases during live streams.

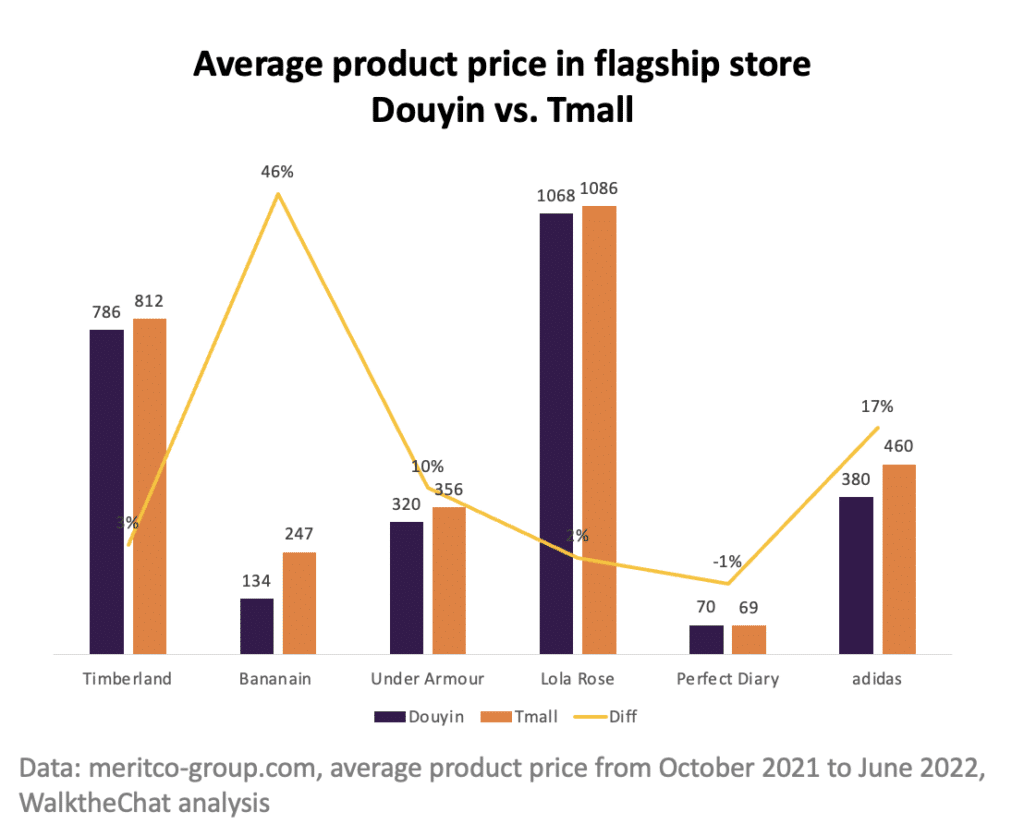

Pricing is lower than Tmall

Below brands are from the top 100 best-performing Douyin stores. Comparing the average product price in Douyin and Tmall flagship stores, the pricing on Douyin is around 10-20% lower.

Higher pricing on Tmall could be a result of Tmall users’ stronger purchasing power. Usually, Tmall users have a stronger purchasing intent, while Douyin users have a stronger need for entertainment.

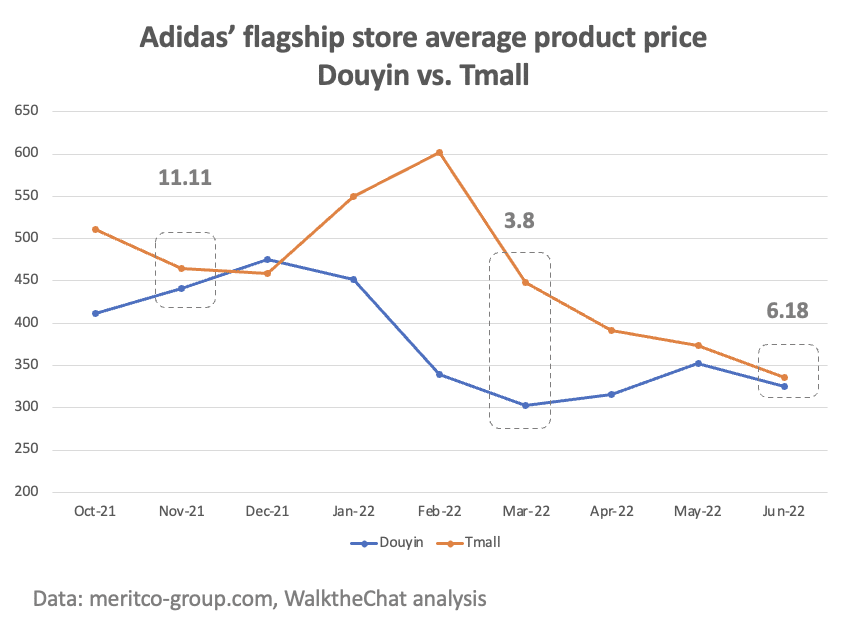

Adidas is one of the top 5 Douyin stores. Its price on Tmall is 17% higher than Douyin throughout the year. The difference reaches over 100 RMB from January to April.

A stronger focus on Douyin during the non-event period

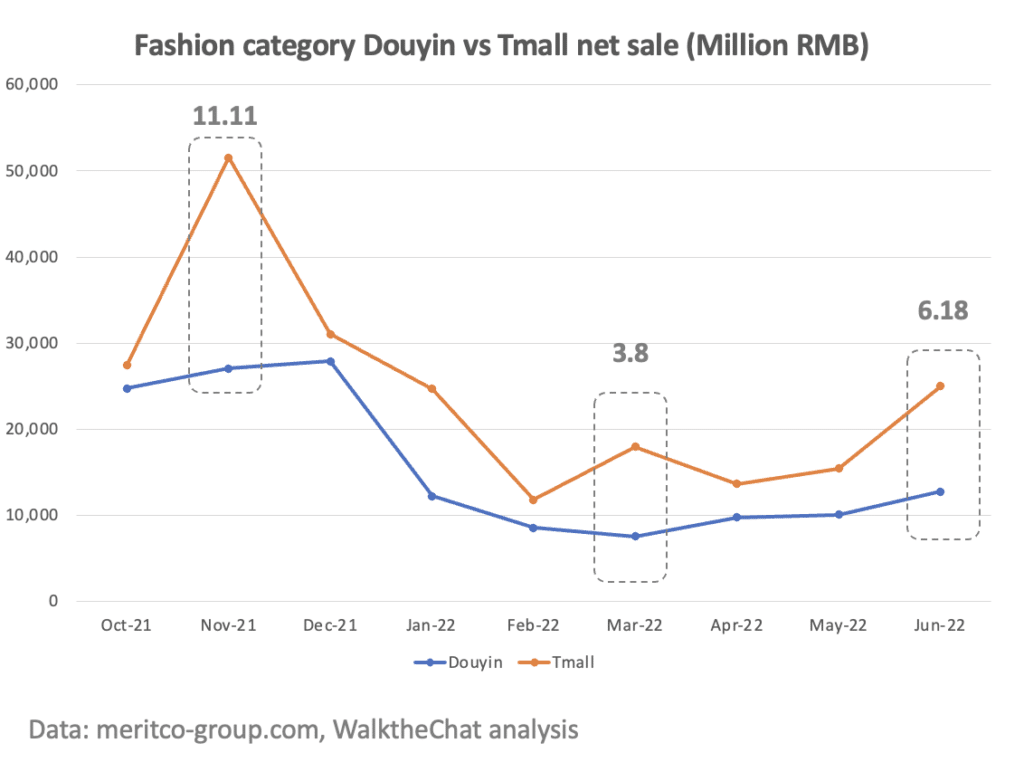

The focus of Douyin marketing and live-streaming should be during the non-event period. Douyin sales tend to remain relatively stable or even drop during large Tmall events such as Double 11 and 618. The sales gap usually closes before and after the event period.

Brands can focus on driving traffic to Tmall and setting relatively competitive prices during the event periods.

According to the above stats, Douyin already reached 39% of Tmall’s net sales. But the Tmall net sale might be underestimated. Tmall officially claim to have 8,100 million RMB in GMV in 2022, and Douyin officially claimed only 730 million RMB GMV in 2021, less than 10% of Tmall’s. But it’s clear that Douyin’s e-commerce continues growing and the gap between Tmall and Douyin is closing.

How to optimize Douyin Live-streaming

Focus on the hero product

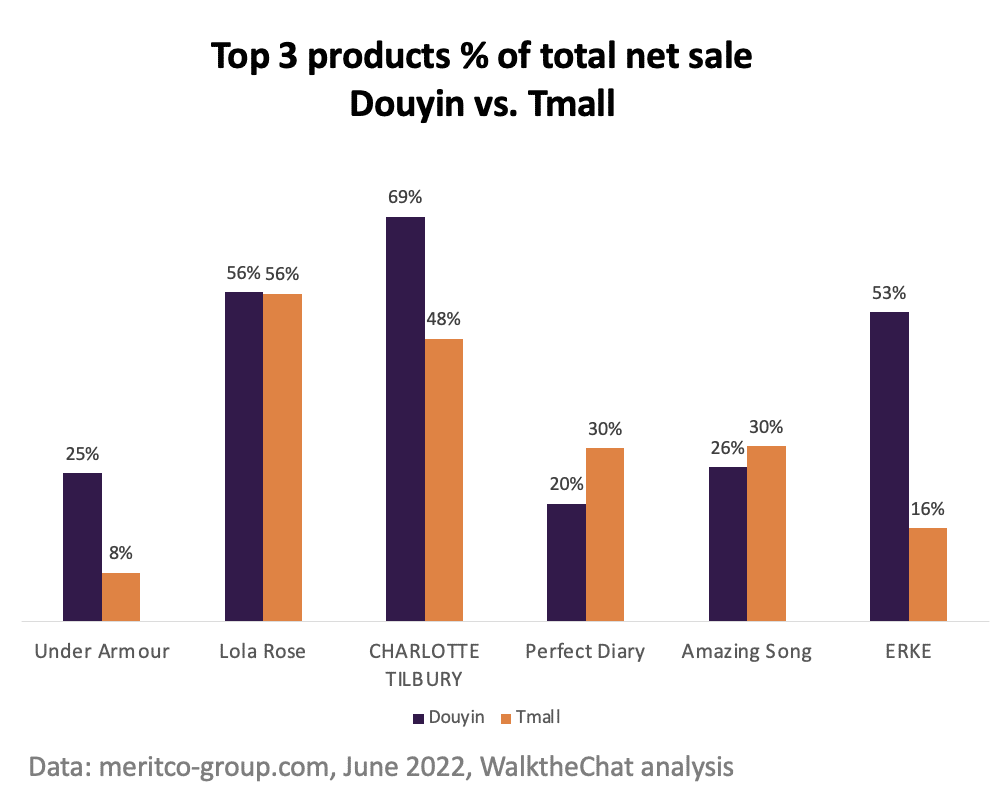

Just like the hero product strategy on Tmall, Douyin also emphasizes the top-selling products. Over 20% of sales are from the 3 top-selling items. Many brands even have over 50% of total sales from the top items. This is significant since many brands have over 100 products listed. For example, Erke (a Chinese sports brand) has 890 products, and Under Armour has over 300 products.

Think of live-streaming as the last step of Douyin conversion funnel

Live streaming does not work alone, it’s the end of the conversion funnel.

The top of the funnel is the source of the traffic. Traffic comes from display ads, content, and organic live-streaming traffic from Douyin.

According to Newrank, the source traffic from a brand’s own live-streaming when first starting live-streaming could be broken down according to categories:

| Brand Category | Paid traffic | Organic traffic from live streams | Organic traffic from content posting |

| Top-tier brand in skincare and cosmetics | 80% | 10% | 10% |

| White-label F&B product | 10% | 40% | 50% |

| White-label fashion brands | 10% | 60% | 30% |

The more a brand relies on brand awareness, the more it needs to run advertising to kick-start the traffic.

Use content to generate traffic to your live-streaming account

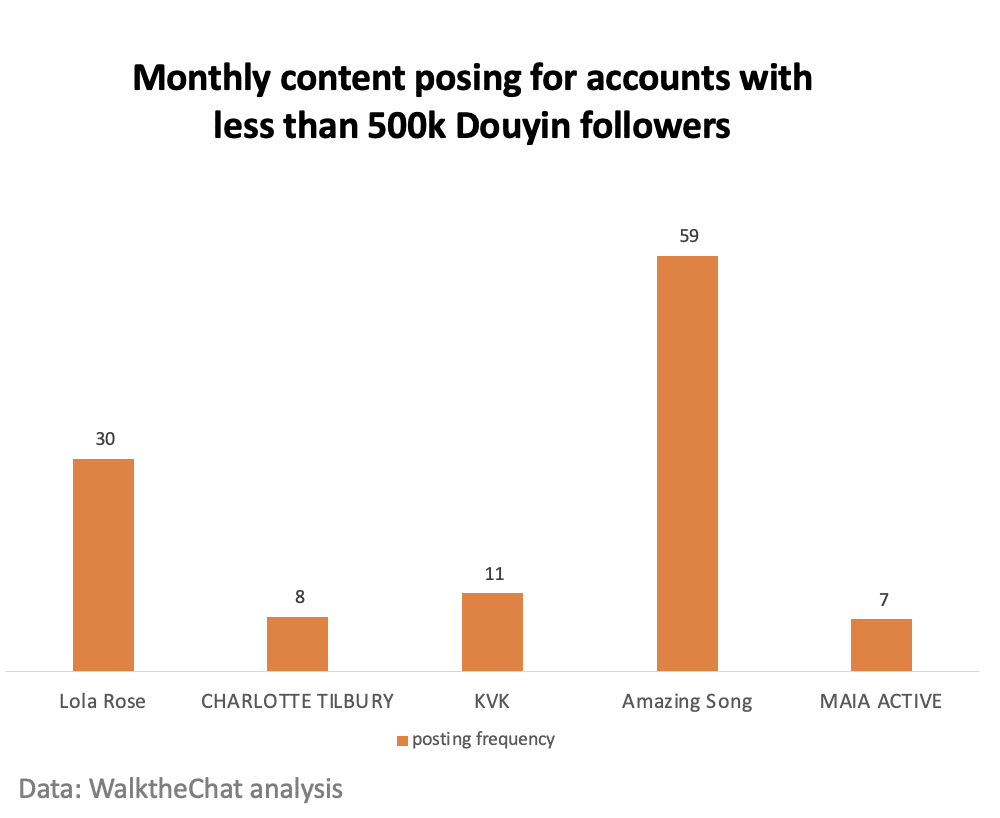

Quantity over quality when it comes to driving traffic to the brand’s own live-streaming. The Douyin algorithm made content performance unpredictable, thus posting more is a safer bet to generate more traffic.

Brands with over 500k Douyin followers, tend to create a separate account just for live streaming. These accounts’ has very promotional content, very different from the usual concept video a brand would produce with a bigger budget. These are just short clips from the live streaming. Often using the same editing template, music, and special effects to make it simple to produce. Most brands post over 10 videos per day to drive traffic to live streamings.

For most brands with less than 500k followers, a brand can simply use the same account to set up Douyin live-streaming. In this case, the content still needs to be creative, and on-brand. The brand could post less frequently.

Below is the type of content Lola Rose, a 1,000-2,000 RMB jewelry brand, generates on Douyin. It’s just 2 pictures with simple background music. Easy to produce in bulk. This video got around 100 engagements on Douyin. The same video asset could also be used on the brand’s Tmall store.

Another type of content strategy is to post less frequently but rely on display ads to generate traffic. Premium brands with large budgets and restricted content requirements usually do so.

Discounts and user engagement

Engagements and purchase actions will boost the organic traffic to a live-streams.

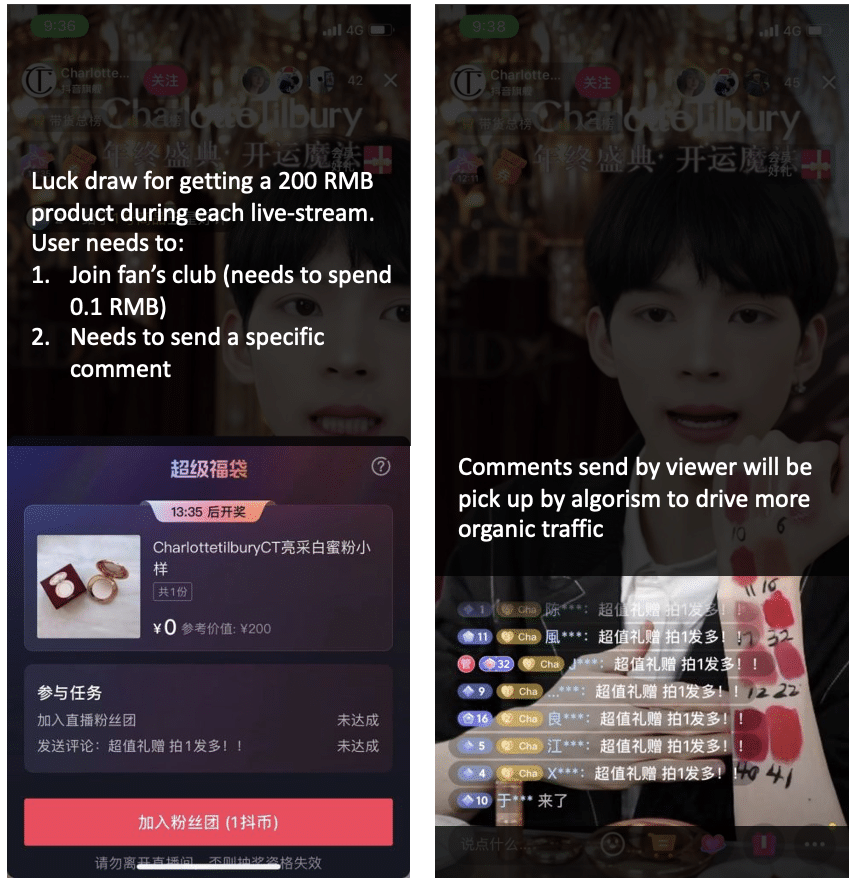

Charlotte Tibury’s team set up 1-2 lucky draws for a 200 RMB product during every live-streaming. To participate, viewers will need to pay 0.1 RMB to join the Fan club and add a comment. These are small but effective actions that will trick the Douyin algorithm to bring even more traffic. The host will decide when to release the lucky draw result, thus encouraging viewers to stay longer to wait for the result.

Douyin has many other features to encourage users to spend time on live streamings, such as limited products, time-sensitive coupons, small giveaways, and comment-lucky draws.

Participate in Douyin events to gain traffic

Same to Tmall, Douyin also has its own event schedule for the e-commerce holidays. Participating in the official events will gain traffic to the store.

Set the price lower than Tmall

Brands can use tactics such as different hero products, gift-with-purchase, or even develop Douyin-specific SKUs to set up a lower pricing strategy for Douyin. In general, many brands would price 10-20% cheaper on Douyin than Tmall.

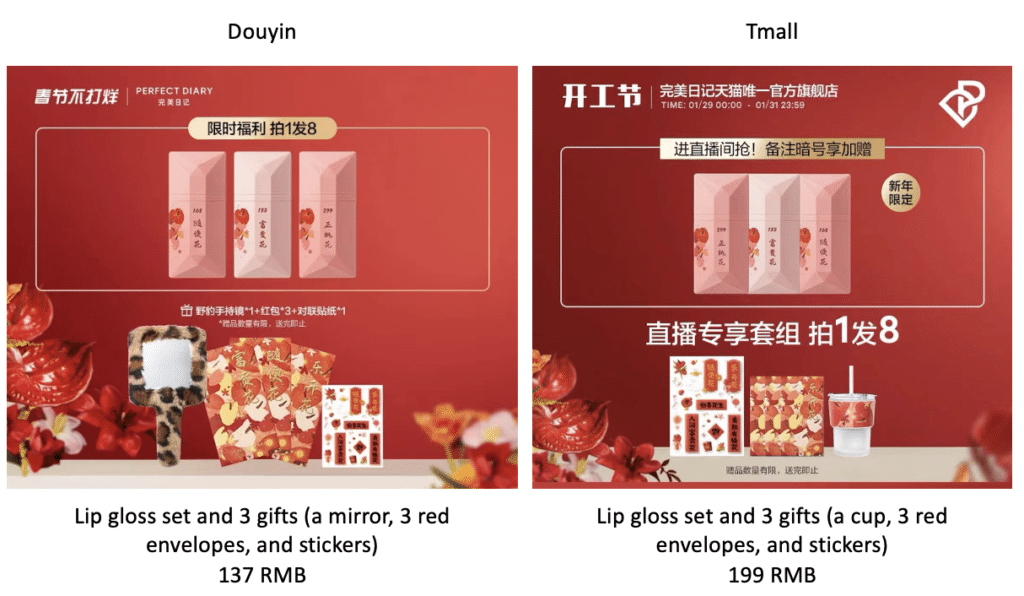

Gift-with-purchase

Some brands use gift-with-purchase to set different pricing while avoiding users directly comparing prices across Douyin and Tmall.

Perfect Diary promotes the lip gloss set during flagship store live-streaming and sets the price 31% lower than Tmall. Gift-with-purchase is able to justify the pricing differently and avoid a direct price comparison.

Douyin-specific product

Some brands also develop Douyin-specific SKUs to offer a cheaper pricing product in Douyin, while avoiding direct competition with Tmall.

Should brands invest in Douyin live-streaming?

Despite the impressive aggregated sales result, most brands still struggle to manage their own Douyin live streaming.

High upfront cost

The upfront investment is huge:

- Over 10 hours of daily live-streaming

- An operation team to assist with content posting, promotion, ads, and technical support through daily operation

- A great salesperson as the live-streaming host who also needs to match the brand’s style

- Supply chain system to support the surge of demand during peak periods

- Deal with excess inventory when performance is below forecast

Traffic concentrates on top brands

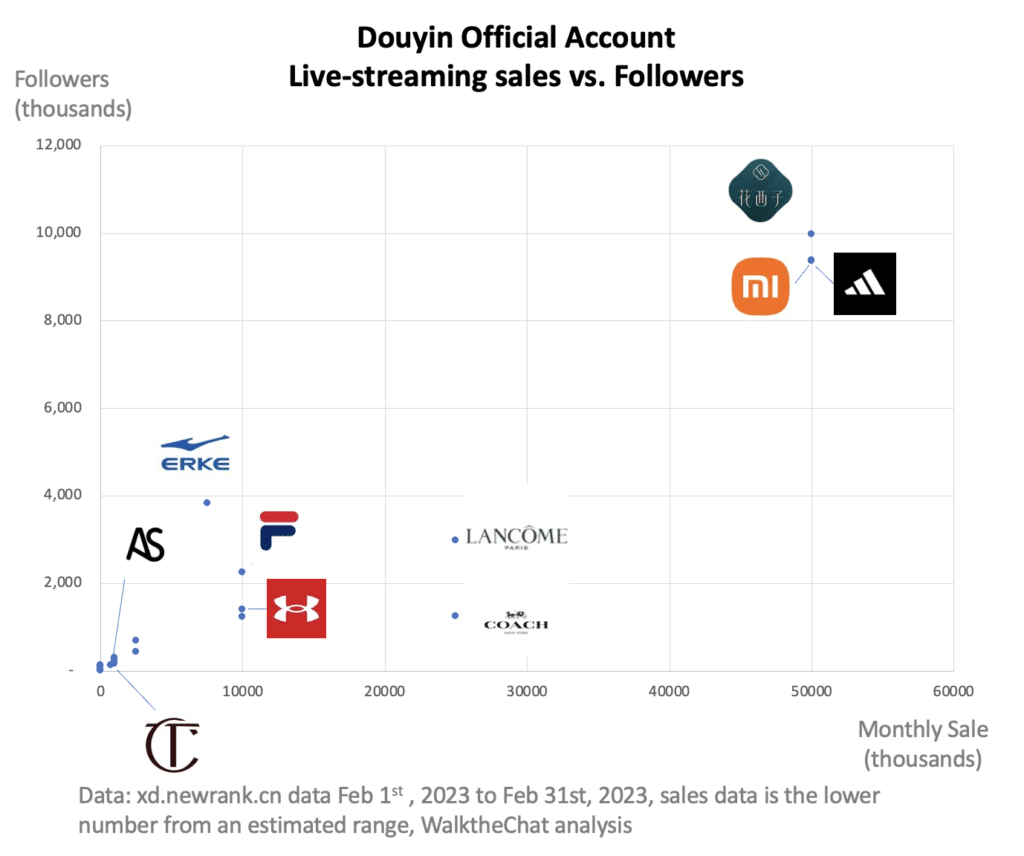

Another barrier to entry is the current live-streaming sales are extremely concentrated on top-tier brands. Xiaomi, Florias (Chinese cosmetics startup), and Adidas are among the best-performing brands on Douyin. These brands already have over 9 million Douyin followers and the monthly sales from brand live-streaming are over 50 million RMB.

The 2nd tier of brands with strong distribution channels and high brand awareness in all tier cities in China. These brands usually have over 1 million followers on Douyin and have 10-30 million monthly Douyin live-streaming sales. For example, brands such as Lancôme, COACH, Erke (Chinese sports brand), and Fila.

Most good-performing brands fall under the 3rd tier, with 100-500k Douyin followers and live-streaming sales of 1-2.5 million RMB per month. The majority are Chinese brands with average pricing under 300 RMB. Some premium brands in this category that stands out are Charlotte Tilbury and Amazing Song (Chinese startup bag brand), both with average live-streaming price above 500 RMB.

The brands above are all from the top 200 best-performing Douyin store brands in their category. Over 95% of these 200 brands are Chinese brands. Many sell commodity products with little brand awareness. The majority of brands still do not run their own live-streaming or generate any sales from it.

For most SME and mid-tier brands, live-streaming will bring low ROI during the first year. Instead, working with influencers who already have strong followers is a much cheaper way to gain short-term sales and build initial traffic on their own accounts.

Case studies

Under Armour

Under Armour has 24 Douyin accounts, 6 of which run daily live streamings: 3 are official accounts (the flagship account, Under Armour Women, Under Armour Kids), and the other 3 belong to distributors.

Lots of similar content

The Under Armour flagship store posts 20 videos per day. These videos are just video clips from the live-streaming events. All the content uses the same editing template, some don’t have any editing at all. These videos usually got less than 10 engagements, and the purpose of repetitive posting in large quantity is to show up on the user’s feed and drive traffic to the brand’s live-streaming event.

Under Amour’s Douyin live-streaming is on 16 hours per day. It has a 237 average viewer count (the number of viewers watching your live video at one time), and 105k total viewers per live streaming. In February, the top performance show brought 1.3 million RMB sales, and a total of 19.9 million RMB monthly GMV, according to New Rank.

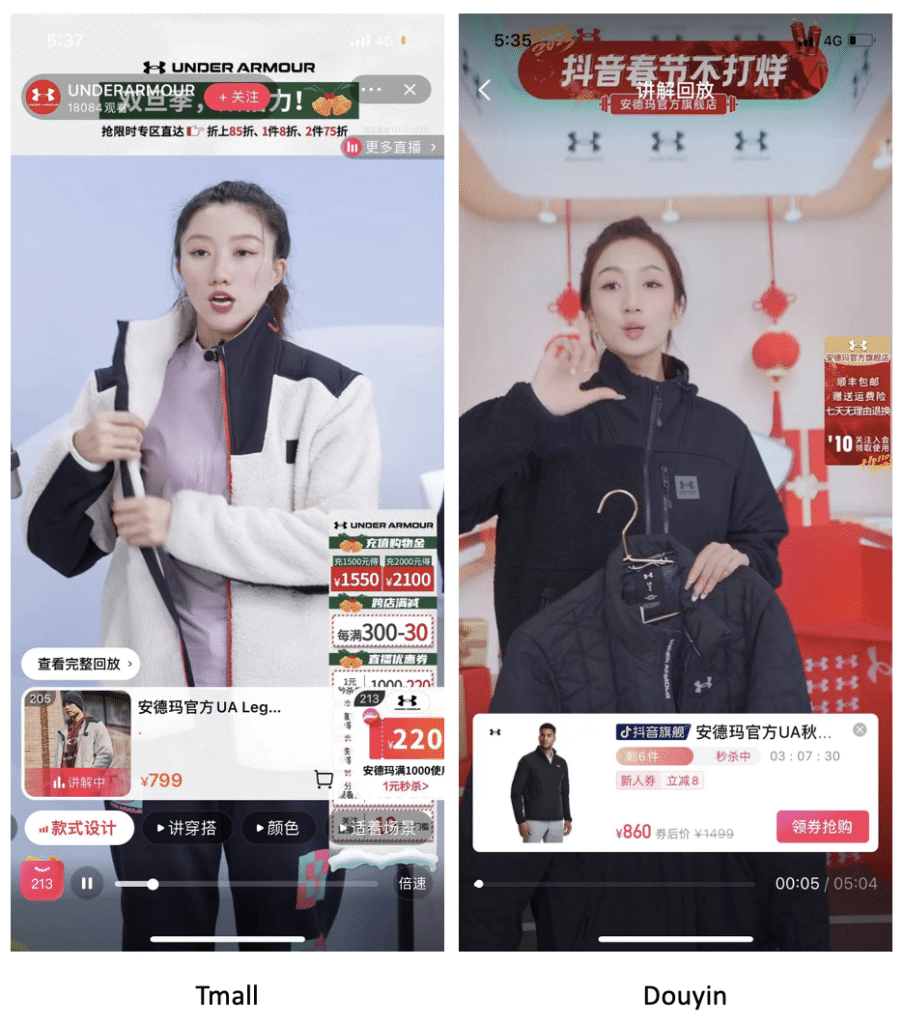

The live-streaming script is similar to Tmall

The live-streaming script is very similar between Douyin and Tmall. Both hosts encourage users to join the member club, claim additional coupons and encourage impulse purchases. Douyin’s host spoke a bit faster and is more enthusiastic about sharing the product. Tmall’s host tends to engage with user comments a bit more.

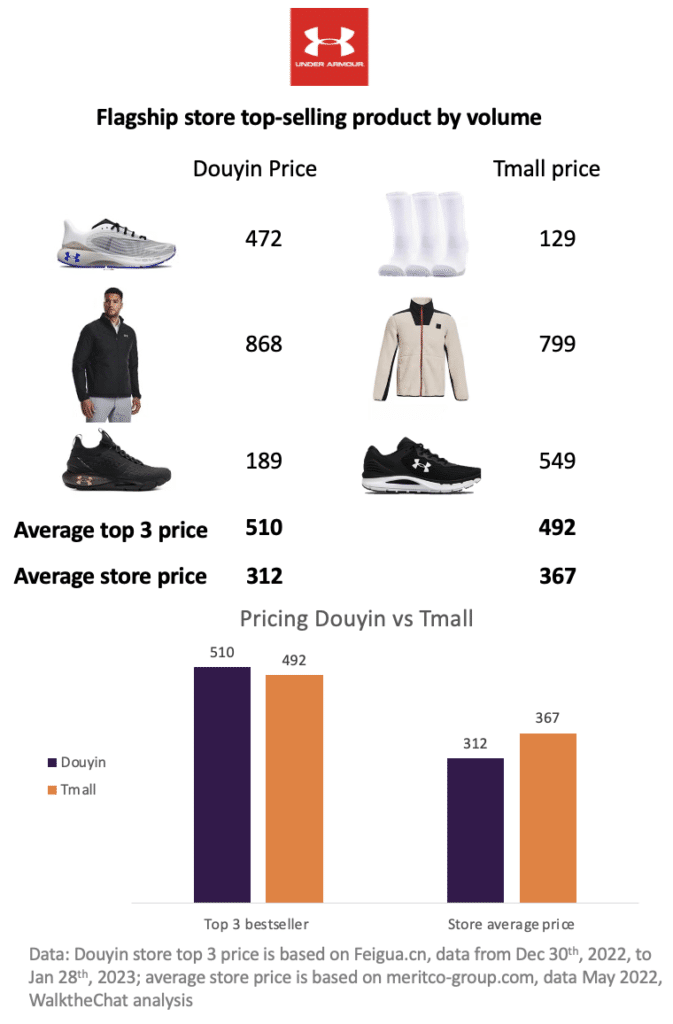

The hero product is cheaper than Tmall

The 3 top-selling products in the Tmall flagship store and the Douyin flagship store are different, but the price range is similar.

Hero product also gets brand would put a lot of emphasis during the live-streaming. For example, the top-selling men’s jacket was appears 30 times during every Douyin live-streamings in January 2023.

Douyin has a slightly higher pricing hero product in the men’s jacket category, 60 RMB more expensive than the hero product on Tmall. However, if we compare the same product, the Douyin flagship store’s pricing is significantly lower than Tmall.

Brands that want to better control pricing in multiple channels, could consider develop up platform-specific SKUs. Under Amour’s hero product, the ColdGear React jacket is only sold on Douyin. This way even when users find out a similar jacket on Tmall is sold for 300 more, they won’t be too angry due to the slight design difference.

Most Douyin sales are from the official account, and Douyin sales are strong during non-Tmall-event periods Douyin sales

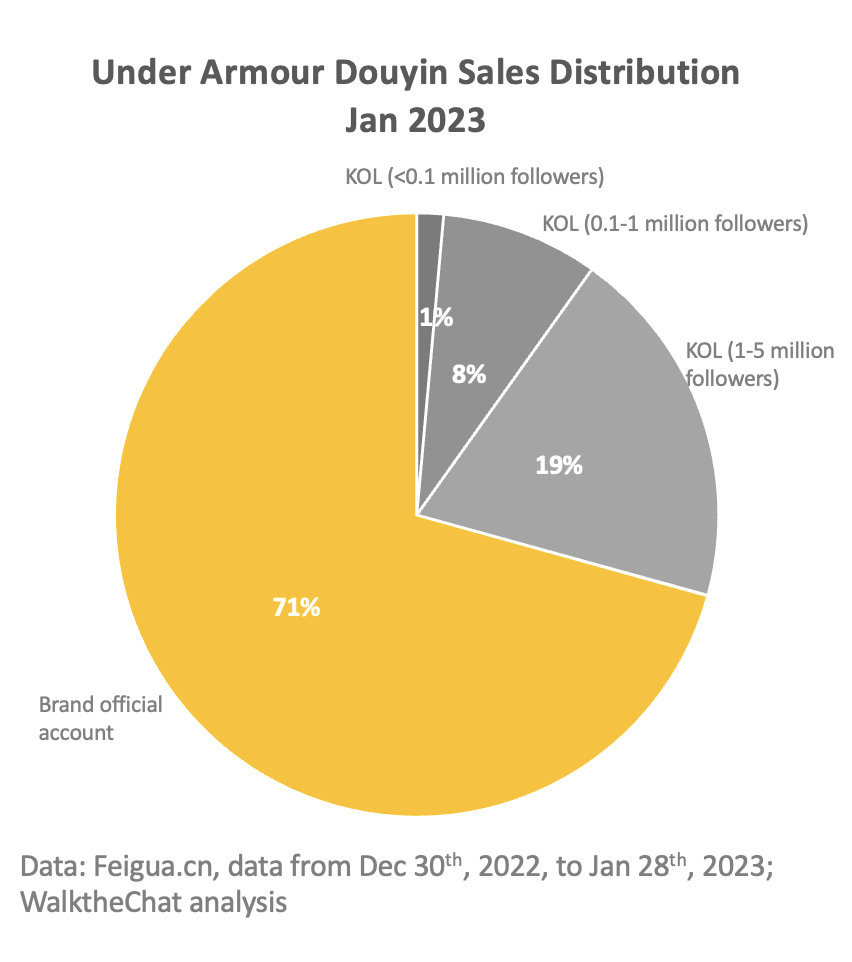

Unter Armour sold 19.9 million RMB during Jan 2023 via the brand Douyin live-stream according to New Ranks. This is the majority revenue source for Douyin sales. And KOL live-streaming and sales only take 29% of total Douyin sales.

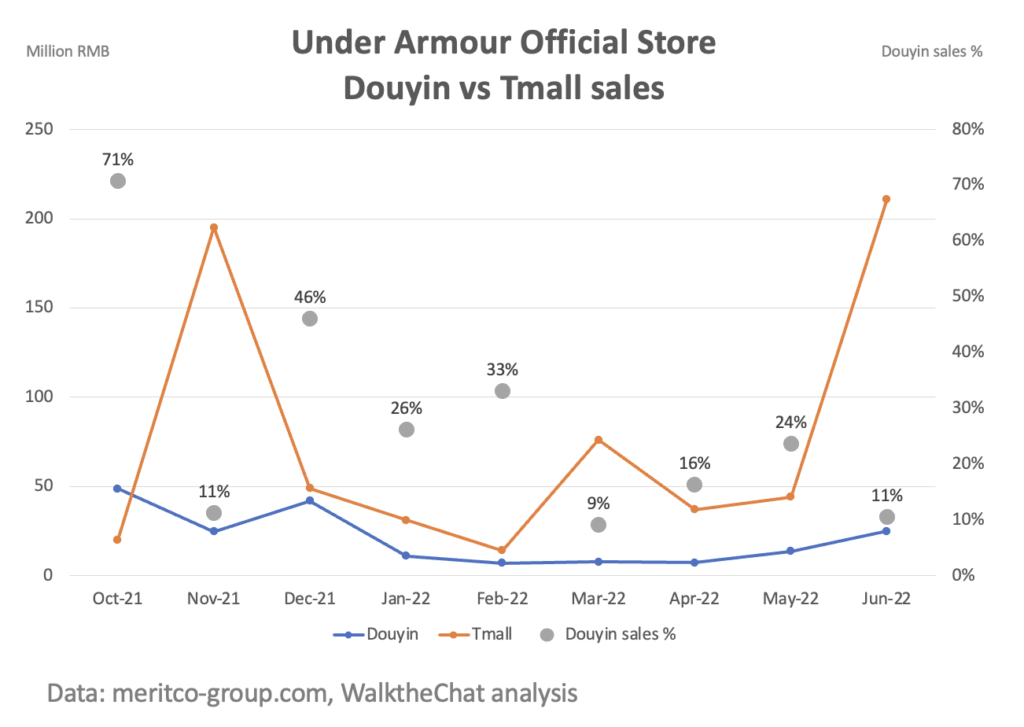

In comparison to Tmall, Douyin’s sales are very strong during the non-even period, especially before the event. In October, Douyin sales even exceeds Tmall’s.

Having Tmall and Douyin sales compared side by side definitely shows the strong sales position of the Douyin channel. Overall, Douyin’s sales take 21.6% of total Douyin and Tmall sales.

Conclusion

Douyin brand live-streaming is growing very strong with a strong concentration on the top tier brands. Douyin’s product pricing strategy should be lower than Tmall, and investment could focus on non-Tmall event periods. The up-front investment is high for most brands. Brands need to focus on content creation and ads to kick-start. Premium brands with less than 100k Douyin followers could hold off on launching their own live-streaming and focus on working with KOL to build initial momentum. (Source: WalkTheChat.com)

Visit HPA-China’s Information Hub, CLICK HERE