China’s anti-aging market is booming due to factors like an aging population, increasing wealth, and cultural emphasis on youthful appearance. This growth spans skincare innovations, medical procedures, and supplements, offering significant opportunities for both domestic and foreign players amidst evolving regulations and consumer trends.

China’s anti-aging market is experiencing a remarkable surge, driven by a convergence of factors.

As the global aging population escalates, China finds itself at the forefront of a profound demographic transformation. Projections from Euromonitor suggest that by 2030, China will witness a surge of nearly 90 million individuals aged 65 and above—equivalent to the population of Germany. Responding to this demographic shift, the government has implemented policies promoting late retirement.

Younger demographics, influenced by global beauty trends, aspire to prevent premature aging. Rising wealth, especially among the middle class, empowers investment in premium anti-aging products. Chinese culture’s emphasis on youthful appearance, amplified by social media, fuels demand across age groups. Additionally, increasing health consciousness drives demand for products addressing age-related concerns and skin health.

Consumer consciousness regarding anti-aging solutions has intensified across all market segments. From skincare innovations to medical procedures, the market is committed to offering comprehensive solutions to combat the signs and effects of aging.

In this article, we delve into the China’s anti-aging market, examining emerging trends, market drivers, and consumer preferences.

China’s anti-aging market overview

The anti-aging market covers products, services, and technologies geared towards counteracting the signs and impacts of aging on the human body. It spans skincare and hair care items, supplements, injectables, and devices utilizing technologies like laser, ultrasound, and radiofrequency. These aim to diminish wrinkles, age spots, and other age-related markers.

The global anti-aging sector is projected to witness a compound annual growth rate (CAGR) of around 6.7 percent between 2022 and 2027. Having reached approximately US$63 billion in 2021, the market is expected to surge to US$93 billion by 2027.

Meanwhile, China’s anti-aging market size is expected to reach US$15.02 billion by 2024.

The country’s anti-aging cosmetic sector surged to CNY 82 billion in 2021 and is forecasted to achieve RMB 153.2 billion (US$82.05 billion) by 2026, reaching 13.3 percent CAGR, according to data from Euromonitor.

Market growth drivers

The market for anti-aging solutions in China is propelled by a combination of factors, including the preferences of younger demographics and the aging population. Younger generations are influenced by global beauty trends and aspire to prevent premature aging, while older individuals seek effective solutions to maintain their youthful appearance.

Meanwhile, China’s economic growth has led to increased wealth among consumers, empowering them to invest in premium anti-aging products. Middle-class consumers, in particular, are willing to spend on advanced skincare routines, medical beauty procedures, supplements, and luxury brands to preserve their youthful look.

As mentioned earlier, Chinese culture places a strong emphasis on youthful appearance and beauty, driving the demand for anti-aging products. Youth is associated with good health, prosperity, and success, with social media platforms like WeChat and Weibo amplifying the pressure to maintain an attractive appearance.

On the other hand, rising health consciousness among Chinese consumers is also fueling the demand for anti-aging products. Consumers seek products containing beneficial ingredients to address age-related concerns and maintain skin health. With an aging population, there is also a growing interest in preventing age-related diseases and maintaining overall well-being.

Anti-aging skincare and cosmetic products

In response to the abovementioned diverse drivers, businesses of multiple sectors, such as skincare, cosmetic, pharmaceutical, medical beauty, as well as fitness, have been striving to provide comprehensive solutions to combat aging.

In the skincare area, brands are not only developing specialized skincare lines but also offering a range of procedures tailored to address the needs of mature skin. These procedures focus on enhancing elasticity, reducing wrinkles, and addressing premature aging signs through advanced techniques and technologies.

Anti-aging products, specifically, have seen growth across e-commerce platforms and social media commerce like Taobao, Tmall, Douyin, and JD.com, emerging as focal points for the category’s expansion. Following this trend, eye care and facial masks have also experienced growth. According to an industry report, among the top 50 products in the first half of 2023 on the Tmall platform, 21 products are anti-aging products, accounting for more than 40 percent, and the star products of the top brands are highly integrated with anti-aging products.

Some anti-aging ingredients have gained growing popularity among consumers, such as retinol, Pro-Xylane, carnosine, fullerene, astaxanthin, and so on. Among them, retinol products grew the fastest, benefiting from the long-term promotion of some skincare concepts among consumers.

Amidst the variety of anti-aging products available, premium anti-aging cosmetics stand out by securing a larger market share compared to mass-market alternatives, already seizing 67 percent in 2021. This preference likely arises from consumers’ inherent trust in premium brands to provide superior quality, advanced formulations, and innovative ingredients in their anti-aging cosmetics.

Capitalizing on this trend, the anti-aging sector has performed well in the M&A market, with some high-profile transactions concluded in 2022 and 2023. Meanwhile, the number of registered anti-aging skincare products has been surging. In 2023, at least 50 new anti-aging products were listed in the domestic cosmetics market.

Leading players in China’s skincare market

The anti-aging skincare market in China is primarily dominated by a select group of major players, including multinational foreign brands L’Oreal, Procter & Gamble, The Estée Lauder Companies Inc., and Oriflame Cosmetics AG. These companies have achieved significant success by consistently introducing new products and technologies tailored to a diverse consumer base with varying skin types.

For example, L’Oréal Paris witnessed remarkable success with the launch of the Revitalift Filler Ampoules in China. The product quickly gained popularity, selling over 2,000 units within the first minute of its release and surpassing a million units in sales within just three months. This highlights the effectiveness of their strategy in capturing consumer interest and demand in the rapidly growing Chinese market for anti-aging skincare products.

In addition to Western competitors, the offerings of Korean anti-aging skincare brands have gained tremendous popularity among Chinese consumers. Brands like Whoo, revered as a “national treasure” luxury skincare brand in South Korea, have successfully penetrated the Chinese market. Whoo’s appeal lies in its use of precious herbal extracts such as ginseng, lingzhi mushrooms, and cordyceps, which resonate strongly with Asian women, especially those in China and South Korea.

In addition to well-established foreign brands, domestic cosmetic brands are rapidly climbing the ladder in the anti-aging skincare sector. One notable example is KANS (in Chinese, “韩束”), a Chinese brand founded just 20 years ago, which has quickly risen to become one of China’s top 10 beauty brands. Among its product offerings, the KANS Moisturizing Facial Foam stands out as a leading anti-aging cosmetic in China. Renowned for “filling the gap in the domestic market for scientifically advanced anti-aging products,” KANS strategically focuses on addressing the “evolving anti-aging needs of Asian women of all ages.”

Beyond skincare: The surge of anti-aging therapeutics and supplements

Aging, characterized by adverse changes in overall organism function, is propelled by a complex interplay of biological processes, including genetic mutation, telomere loss, and immune dysfunction. Despite China’s traditional reverence for elders, there is a notable surge in the consumption and adoption of anti-aging products across all demographics. This surge reflects an increasing awareness and pursuit of effective solutions to address age-related concerns among individuals of all ages.

Anti-aging therapeutics

Among segments experiencing high growth is anti-aging therapeutics, fueled by both increased investments in research and development (R&D) and evolving consumer trends.

In 2022, the anti-aging therapeutics market size in China stood at approximately US$49 million and is anticipated to soar to US$183 million by 2030, boasting a CAGR of 18.03 percent over the forecast period. This upward trajectory highlights the escalating demand for anti-aging solutions along with the growing healthcare expenditure within the country.

Anti-aging supplements

In recent years, China has also witnessed exponential growth in the anti-aging supplement market, with sales projected to skyrocket at an annual rate of 74 percent.

Primarily targeted at young to middle-aged women, especially those in first tier and emerging cities, these supplements promise a range of benefits, from firmer skin to a clearer complexion.

Platforms like Xiaohongshu have become hubs for users to share their supplement routines, highlighting the integral role of supplements in the modern Chinese woman’s beauty regimen.

Consumer preferences

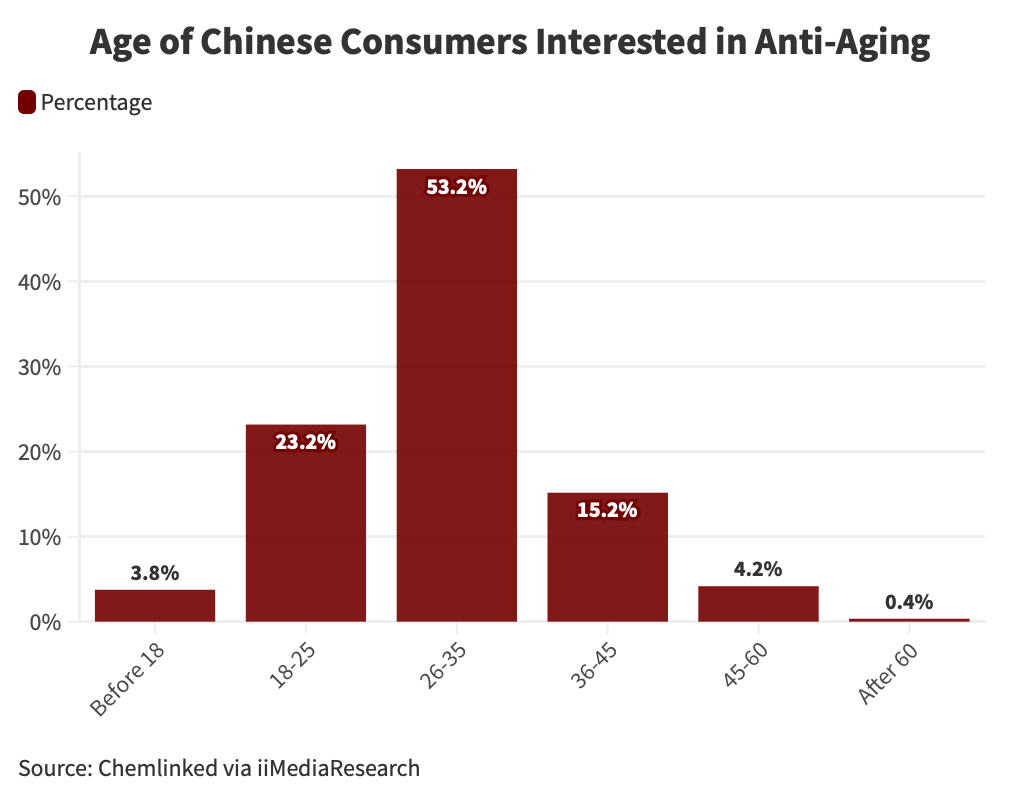

At the heart of China’s anti-aging market lies a diverse array of consumers spanning different age brackets and lifestyles. While a significant segment begins their anti-aging journey in their late twenties to mid-thirties, an increasing number of younger individuals, aged 18-25 are also embracing preventive measures against aging. This demographic shift underscores a broader societal trend: a proactive stance towards aging that starts earlier in life.

The Chinese consumer’s approach to anti-aging extends beyond skincare regimens—it’s a holistic endeavor encompassing fitness, nutrition, and supplementation. With 68.2 percent engaging in fitness activities and 62.4 percent incorporating skincare products into their routines, it’s evident that Chinese consumers prioritize both internal and external well-being. Nearly half of the consumers opt for dietary adjustments and supplements, signaling a comprehensive approach to aging gracefully. In particular, the rise of NMN/NAD+ supplements reflect a growing interest in cutting-edge scientific advancements for longevity and vitality.

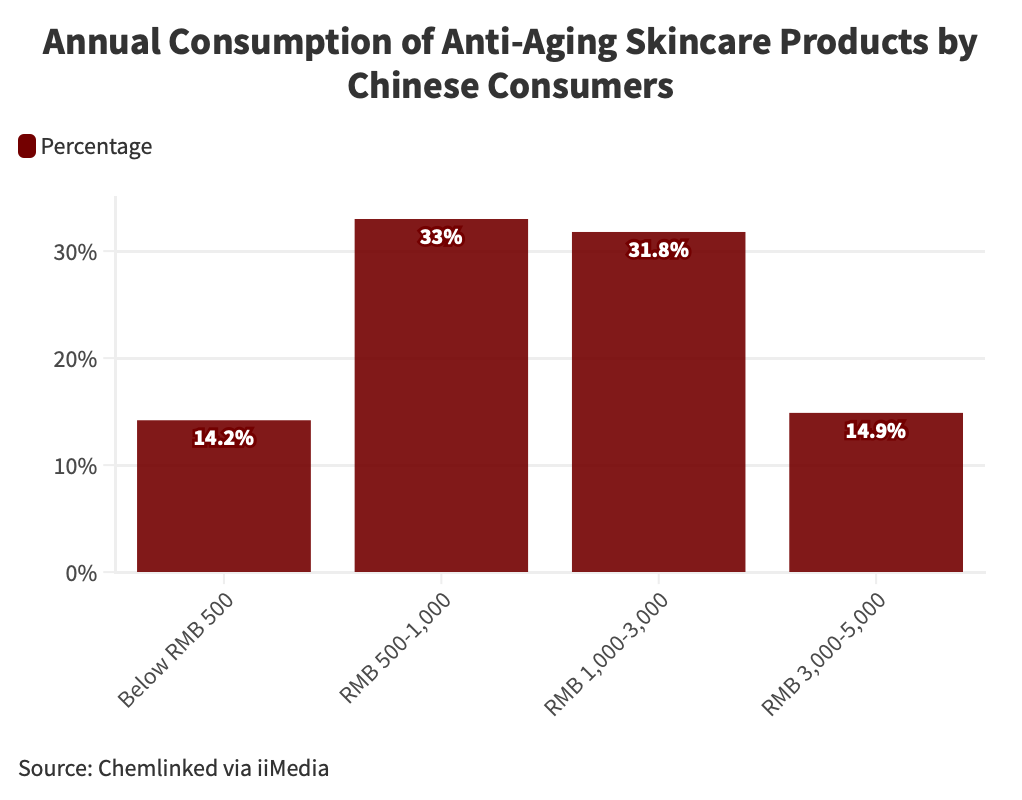

At the same time, Chinese consumers are increasingly inclined to invest more in purchasing anti-aging cosmetics. Last year, a significant portion, exceeding 46 percent of consumers, allocated annual budgets of over RMB 1,000 (US$138.94) towards anti-aging skincare products. This demonstrates their openness to higher-priced anti-aging products and their readiness to make substantial financial investments in preserving a youthful look.

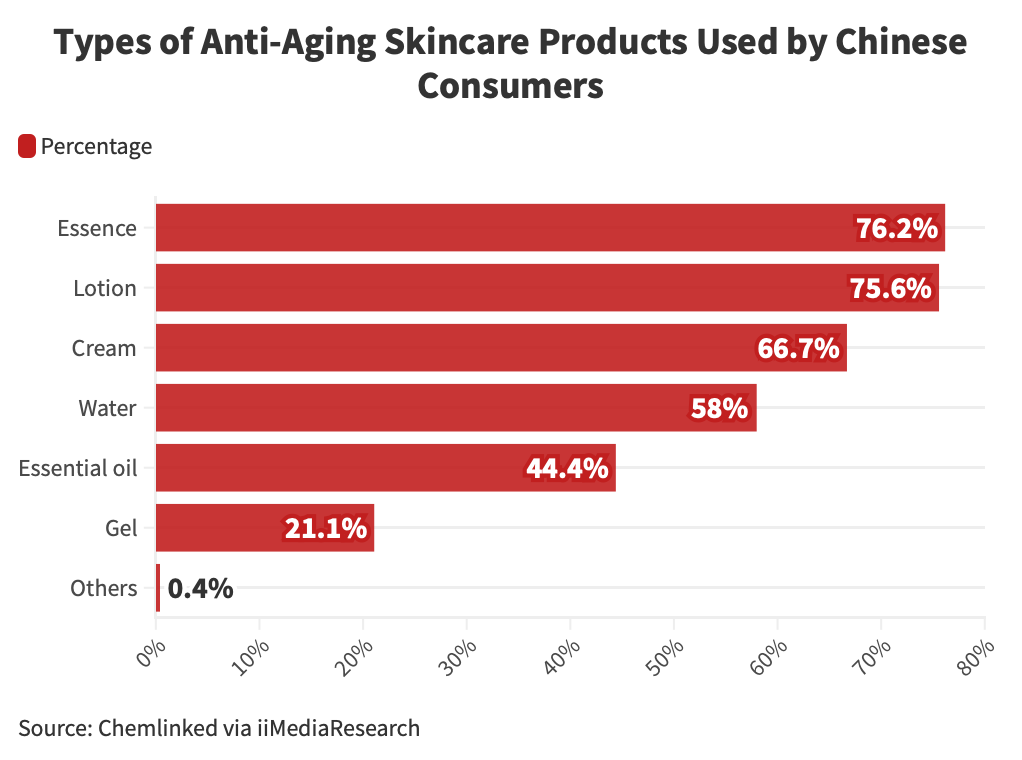

Regarding product categories, consumers exhibited a preference for essence, lotion, and cream. There has been an increasing trend towards anti-aging products infused with essential oils, which resonates with the emerging notion of “oil-based skincare” that has gained prominence in China in recent times.

Emerging trends

Medical beauty and innovative treatments

Medical beauty, heralded as ‘beauty from within,’ has emerged as a highly sought-after avenue in the anti-aging landscape. This segment encompasses both surgical and non-surgical procedures, offering diverse options for individuals seeking age-defying treatments.

Projections for the Chinese aesthetic medicine market suggests robust growth, with the 20-35 age group comprising a substantial portion of users.

Meanwhile, cutting-edge aesthetic treatments have further fueled demand for anti-aging products, with consumers seeking post-treatment skincare solutions to complement their rejuvenation efforts. While the principles of post-treatment skincare closely align with anti-aging goals, consumers are increasingly integrating anti-aging products into their skincare routines to maintain youthful vitality.

At-home beauty procedures and devices

The pandemic-induced surge in at-home beauty routines has propelled the adoption of professional beauty devices, driving the consumption penetration rate of anti-aging devices.

Premium devices equipped with advanced features such as Radiofrequency and Thermolift are gaining popularity among consumers, highlighting a growing emphasis on accessible yet technologically advanced skincare solutions.

Niche single-ingredient products

Niche single-ingredient products have captivated the attention of Chinese Gen Z consumers, who prioritize early intervention in their anti-aging regimens.

With a nuanced understanding of skincare ingredients and a penchant for sharing opinions via social media, Gen Z individuals are reshaping the anti-aging landscape by gravitating towards brands that offer transparency and efficacy.

Key distribution channels: E-commerce and social media commerce

In recent years, China’s e-commerce has embraced innovative technologies and marketing approaches, fundamentally reshaping consumer engagement with different brands and products categories. With an estimated revenue of US$1.49 billion, China has already surpassed the United States to become the world’s largest e-commerce market in terms of sales.

Furthermore, the Chinese digital commerce landscape has seen the rise of virtual livestream anchors and the increasing influence of social media commerce platforms like Douyin and Xiaohongshu.

Hence, it is no surprise that e-commerce and social media commerce have turned out to be so influential in dictating trends and commerce volumes in the anti-aging market as well. The June 2023 data from Douyin reveals that anti-aging liquid essence products generated a gross merchandise volume (GMV) of RMB 4 billion (US$561 million) to RMB 7 billion (US$983 million), while anti-aging lotions/creams reached a GMV of RMB 5.85 billion (US$821 million) to RMB 8.75 billion (US$1.23 billion).

The Chinese e-commerce and social media commerce landscape presents abundant opportunities for anti-aging brands, while also requiring a nuanced strategy and cultural awareness. Brands must adeptly navigate this dynamic arena, blending innovative content with a keen awareness of market dynamics and Chinese consumer preferences. It’s imperative to prioritize an enriched customer experience, ensuring that every interaction fosters trust and satisfaction. By embracing these principles, anti-aging brands can also leverage the power of livestreaming platforms to forge meaningful connections with their audience and drive sustained growth in the ever-evolving market.

Regulatory framework

Skincare and cosmetics

China’s beauty and personal care industry operates within a regulatory framework overseen by two key authorities: the State Administration for Market Regulation (SAMR) and the National Medical Products Administration (NMPA). One of the most significant regulatory frameworks within the sector is established through the Regulations on Supervision and Administration of Cosmetics (2021).

Moreover, the regulatory framework for anti-aging cosmetics also falls under the categorization of cosmetics as either ‘special cosmetics’ or ‘general cosmetics.’ Special cosmetics encompass products such as hair dyes, hair perming agents, freckle-removing (whitening) products, sunscreens, anti-hair loss products, and cosmetics with new efficacies. On the other hand, general cosmetics include all other cosmetics not classified as special.

The determination of whether anti-aging cosmetics require registration or record filing depends primarily on their classification as either special or general cosmetics. When applying for cosmetics registration or notification, the applicant must indicate the product classification code according to the Cosmetics Classification Rules and Catalogue, which divides cosmetics by their efficacies into 26 different categories. Interestingly, the term “anti-aging” is not explicitly listed among the recognized efficacies.

Among the 26 efficacy categories, the closely related efficacies to skin anti-aging are termed as “anti-wrinkle” and “firming.” Considering that “anti-wrinkle” and “firming” are very commonly listed as the core functions of the anti-aging products, companies that want to sell anti-aging products in China are advised to carefully verify whether they need to go through the registration process.

It is crucial that any claims made by companies regarding the anti-aging effects of their products are fully supported by comprehensive evaluation reports. This cautious approach helps to mitigate the risk of regulatory penalties and ensures compliance with the established regulatory guidelines in China’s cosmetics market.

Medical devices

Functional skincare products are divided into several categories, with medical-grade skincare items primarily falling under the classification of ‘medical devices.’

In China, medical devices are classified based on risk levels—that is, Class I, Class II, and Class III. The classification is based according to the following criteria:

- Class I devices pose minimal risk and are managed through routine protocols to ensure safety and efficacy.

- Class II devices present moderate risks, necessitating stringent control measures for safety and efficacy assurance.

- Class III devices pose the highest risks, requiring specialized protocols and rigorous oversight for safety and effectiveness.

China operates a system of product registration and filing management for medical devices. Class I devices undergo filing management, while Class II and III devices undergo registration management.

For Class I devices, filers must submit documentation to the local district-level drug supervision and management departments. For Class II devices, registrants submit applications to provincial, autonomous region, or directly administered municipality drug supervision and management departments. Upon approval, a medical device registration certificate is issued. Class III device registrants submit applications to the National Medical Products Administration, receiving a registration certificate upon review and approval.

Supplements

Supplements in China are generally considered under the umbrella categorization of “health foods”. Health food products in China, as defined by the GB Standard for Natural and Health Foods GB16740-2014, encompass two main categories:

- Nutrition supplements, also known as dietary supplements, which aim to replenish vitamins and minerals without providing energy.

- Functional health food products, which claim specific health functions or physiological effects on the body and are intended for specific groups to regulate bodily functions but are not for treating diseases.

China’s regulations for health food registration and filing have been effective since July 1, 2016, mandating that all imported health food products must undergo either filing or registration approval before they can be sold in China.

Exporters can verify product listings or registrations through China’s special food database.

Several key points apply to both product filing and registration processes:

- Application submissions must be authorized by the processor, translated into Chinese, and notarized by a Chinese notarization agency.

- Imported health food products must be marketed or sold in their country of origin for at least one year before being eligible for filing or registration in China.

- Testing and clinical trials by China-approved laboratories are typically required, which can be time-consuming and costly, depending on the health claims sought. Laboratories may have waiting lists of 6–18 months or longer.

More information regarding updated regulations of formula products for special medical purposes can be found in this article.

Opportunities for foreign businesses and investors

Looking at the anti-aging landscape in China, the nation has actively engaged in innovating and developing anti-aging products, aligning with the global surge observed in the anti-aging market over the past few years, and emerging as a prominent player both in the Asia-Pacific region and worldwide.

Around one-third of the cosmetic companies operating in China offer anti-aging products, with foreign brands constituting a considerable share of the market. Both domestic and foreign entities are intensifying their R&D focus to penetrate deeper into the burgeoning anti-aging cosmetics market.

Thus, despite regulatory complexities and competition from alternative treatments, the market holds substantial growth potential covering all of its segments—spanning cosmetics, therapeutics, medical beauty, and medical devices. (Source: china-briefing.com)

Sign Up to Receive China Updates Weekly Newsletter for FREE, HERE

Visit HPA-China’s Information Hub, HERE